Buying a car can feel like navigating a dense jungle, filled with confusing jargon, persuasive salespeople, and a dizzying array of options. But it doesn't have to be. This Buying Guide: Pricing, Models & Where to Buy (New & Used) is your compass, designed to cut through the noise and empower you to make a smart, confident purchase that fits your life and budget. We're here to help you understand the nuances of pricing, decipher the differences between models, and know exactly where to look, whether you're eyeing a brand-new ride or a seasoned pre-owned gem.

Think of this as your personal cheat sheet, equipping you with the knowledge to walk into any dealership or private sale with confidence, ready to ask the right questions and spot the best value.

At a Glance: Key Takeaways for Your Car Hunt

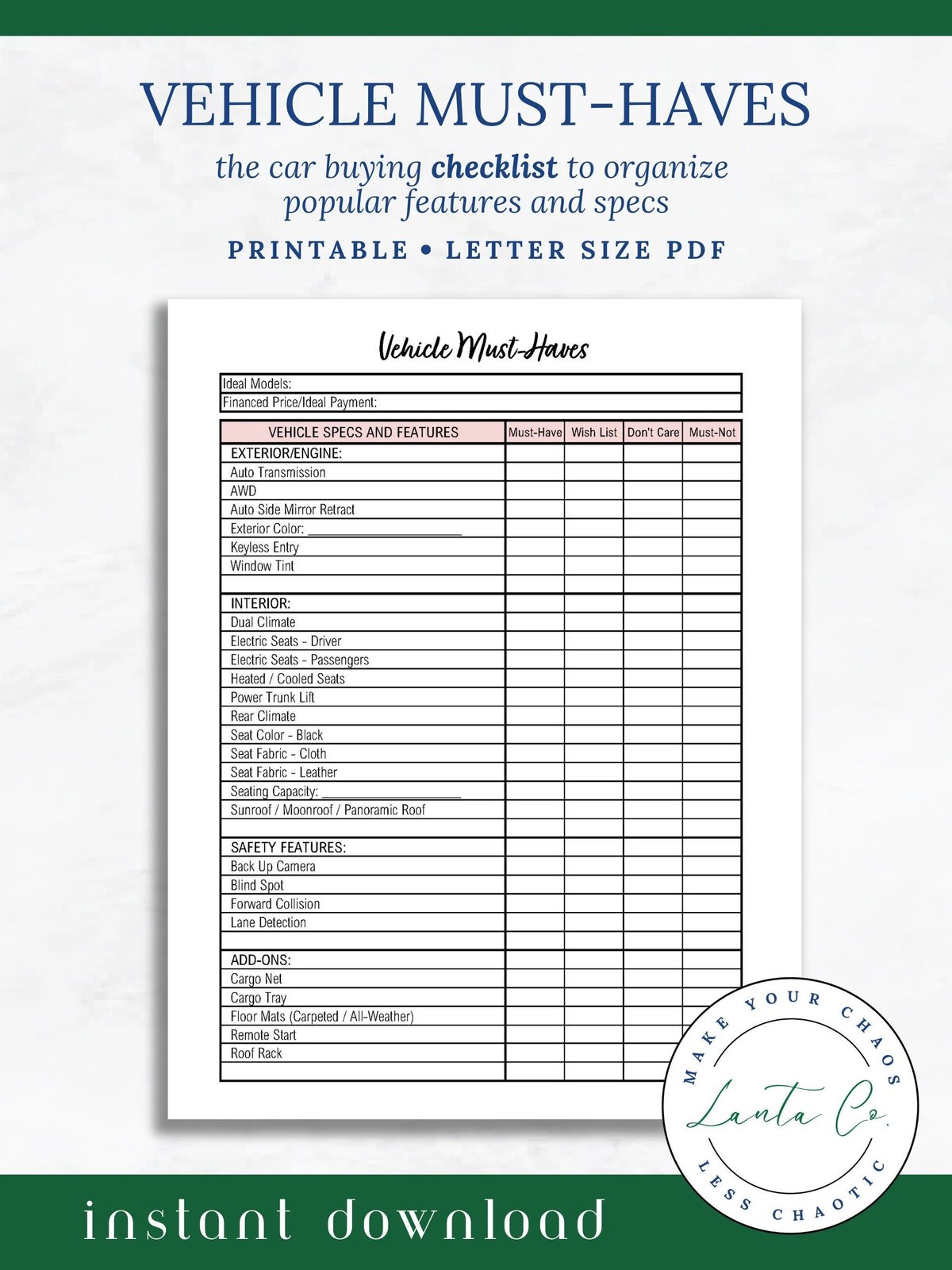

- Know Your Needs: Before anything else, define your budget, lifestyle requirements, and non-negotiable features.

- New, CPO, or Used? Each category offers distinct advantages and disadvantages in terms of cost, reliability, and warranty coverage.

- Understand the Numbers: Familiarize yourself with MSRP, APR, depreciation, and the true "out-the-door" price.

- Research is King: Leverage resources like Consumer Reports for independent assessments of reliability, safety, and owner satisfaction.

- Shop Around: Don't settle for the first offer; compare prices from multiple dealerships, online retailers, and private sellers.

- Get a Pre-Purchase Inspection: Especially for used cars, a mechanic's inspection can save you from costly surprises.

- Negotiate Confidently: Arm yourself with information and be prepared to walk away if the deal isn't right.

The Big Choice: New, CPO, or Used?

Your first major decision sets the stage for your entire car-buying journey. Each option—new, Certified Pre-Owned (CPO), or regular used—comes with its own set of trade-offs. Let's break down what each means for your wallet and peace of mind.

The Appeal of a New Car

There’s nothing quite like the smell of a new car, the pristine finish, and the knowledge that you're the first owner. New cars offer the latest in technology, safety features, and often, a sense of status.

- Price Factor: Expect the highest initial cost. That "new car smell" comes with a premium.

- Finance Factor: Typically, you'll find the lowest interest rates available for new car loans, making monthly payments potentially more manageable for a higher price tag. However, be aware of rapid depreciation – a new car loses a significant portion of its value the moment you drive it off the lot.

- Reliability & History: This is where new cars shine. You get the highest owner satisfaction and top-tier reliability right from the start. You're buying a clean slate.

- Pros: Full bumper-to-bumper warranty for years, cutting-edge safety features, latest infotainment, and no previous owner's "stories."

- Cons: Higher insurance premiums and taxes, plus various hidden costs like destination charges, documentation fees, and dealer add-ons that can quickly inflate the price.

The Sweet Spot: Certified Pre-Owned (CPO)

CPO vehicles sit squarely between new and used cars, aiming to offer the best of both worlds. These are used cars, usually less than five or six years old and with lower mileage, that have been inspected, refurbished, and re-warrantied by the manufacturer or dealership.

- Price Factor: You'll pay a premium over a regular used car, but you’ll still save significantly compared to buying new. It's often the best "value" proposition for many buyers.

- Finance Factor: Interest rates on CPO vehicles are generally higher than new car rates, but often more favorable than those for non-certified used cars.

- Reliability & History: CPO vehicles boast higher satisfaction and reliability ratings than typical used cars, thanks to rigorous multi-point inspections and necessary repairs performed before sale.

- Pros: Save money without sacrificing too much peace of mind. You get an inspected, refurbished vehicle, often with an extended factory warranty, and sometimes perks like roadside assistance.

- Cons: Selection can be limited to specific brands and models, and while inspected, it's still a used car with previous history.

The Value Play: Used Cars

Buying a used car offers the greatest potential for savings and the widest variety of choices. From recent models to older classics, the used market is vast and varied.

- Price Factor: This is where you find the greatest savings, not just on the sales price, but also on associated taxes and insurance, which are often lower for less expensive vehicles.

- Finance Factor: Loan interest rates for used cars are typically the highest of the three categories, especially for older models or those with higher mileage.

- Reliability & History: This is the riskiest category. There's a higher potential for misrepresentation, and the car's best years might be behind it. A thorough inspection is paramount.

- Pros: A massive selection across all makes, models, and price points. The potential for convenient online ordering from platforms like Carvana has also expanded access.

- Cons: Private sales require you to handle all paperwork yourself. Warranties are often minimal or non-existent, and there's a higher potential for expensive repairs as parts wear out.

Here's a quick comparison:

| Feature | New Car | Certified Pre-Owned (CPO) | Used Car |

| :---------------- | :------------------------------------- | :------------------------------------- | :------------------------------------------ |

| Initial Cost | Highest | Moderate (premium over used) | Lowest |

| Finance Rates | Lowest APR | Elevated used-car rates | Highest APR |

| Depreciation | Highest, most rapid | Less than new, more stable | Slowest, much of it already occurred |

| Reliability | Highest owner satisfaction/reliability | High (inspected/refurbished) | Variable (risk of misrepresentation) |

| Warranty | Full bumper-to-bumper factory | Extended factory-backed | Minimal or none (unless purchased) |

| Selection | Current year models | Limited by brand/dealer stock | Massive, diverse market |

| Technology | Latest features | Recent tech | Varies widely |

| Insurance/Tax | Highest | Moderate | Lowest |

Decoding the Price Tag: Understanding Car Costs & Financing

Beyond the sticker price, a car purchase involves a web of financial terms. Grasping this jargon is critical to ensuring you get a fair deal and truly understand what you're committing to. It’s not just about the monthly payment; it's about the total cost of ownership.

Essential Car Pricing Lingo to Master

- MSRP (Manufacturer's Suggested Retail Price): This is the price the automaker recommends, printed right on the window sticker. Think of it as the starting point for negotiation, but rarely the final price.

- Invoice Price: Theoretically, this is what the dealer pays the manufacturer. Historically, buyers tried to negotiate down from MSRP toward invoice. However, a better focus today is the average transaction price – what people are actually paying for a specific model in your area. This reflects real-world market conditions, including current demand and available incentives.

- APR (Annual Percentage Rate): This is the yearly cost of borrowing money for your vehicle, expressed as a percentage. It includes interest and any lender or broker fees, giving you the true cost of your loan. A lower APR means less money paid over the life of the loan. For a deeper dive into how these numbers impact your budget, you might want to review a comprehensive guide to understanding car loans.

- Down Payment: This is the upfront money you pay to reduce the total amount you need to finance. A larger down payment can lower your monthly payments and reduce the overall interest you pay. For leases, it's often called a "cap cost reduction."

- Trade-in Value: The amount a dealership offers for your current vehicle when you're buying or leasing a new one. It's crucial to research your car's independent market value before accepting a dealer's offer.

- Depreciation: This is the silent killer of car value. It's the loss of a vehicle's value over time and miles. New cars depreciate fastest, meaning the true cost of ownership includes this lost value.

- Incentives and Rebates: These are financial enticements from automakers or dealerships. They can come as cash rebates (money back to you), discounted financing rates, or special programs for specific groups like college graduates or military veterans. Always ask what incentives are available.

- Lease: A contract to use a car for a set period (e.g., 36 months) and mileage limit. Monthly payments are typically lower than a purchase because you're only paying for the depreciation during the lease term, not the full car value. At the end, you either return the car or buy it.

- Residual Value: A crucial term for leasing. This is the vehicle’s projected value at the end of the lease term. Your lease cost is largely calculated based on the difference between the negotiated price and this residual value. A higher residual value often translates to lower monthly lease payments.

- GAP Insurance: Stands for "Guaranteed Asset Protection." This specialized insurance covers the difference between your loan or lease balance and the car’s actual cash value if it’s totaled or stolen. Since cars depreciate quickly, you can owe more than the car is worth, and GAP insurance protects you from that financial gap.

Financing Your Purchase: Loan vs. Lease

Deciding between buying and leasing is a critical financial choice, largely dependent on your driving habits and financial goals.

Buying (Financing with a Loan):

- Ownership: You own the car once the loan is paid off.

- Flexibility: No mileage restrictions, you can modify the car, and sell it whenever you like.

- Equity: You build equity as you pay down the loan, though depreciation still impacts resale value.

- Long-Term Cost: Generally more expensive monthly payments initially, but you avoid lease-end fees and can drive the car "for free" once paid off.

Leasing: - Lower Monthly Payments: Typically lower than loan payments for a comparable car.

- New Car Every Few Years: Allows you to drive a new car with the latest features more frequently.

- Warranty Coverage: Usually, the car is under warranty for the entire lease term.

- Mileage Limits: Strict mileage caps (e.g., 10,000-15,000 miles/year) with penalties for overage.

- No Ownership: You don't own the car, so no equity.

- Fees: Potential for wear-and-tear charges and disposition fees at lease end.

Consider your priorities. If you drive a lot, prefer to own, or plan to keep a car for many years, buying is usually the better option. If you like driving new cars often, have a predictable commute, and want lower monthly costs, leasing might appeal.

Finding Your Dream Ride: Researching Models & Reliability

Once you've settled on new, CPO, or used, the real fun begins: identifying specific models. This is where objective data and expert analysis become your best friends. Don't fall for slick marketing alone; dive into reliable sources to ensure you pick a car that truly serves you well for years to come.

The Gold Standard: Consumer Reports (CR) Recommendations

Consumer Reports is an invaluable, independent resource for car buyers. A "CR Recommended" car signifies a strong performer across several critical dimensions, based on their rigorous, anonymous testing and extensive member data. When you see this badge, it means a vehicle has earned its stripes.

Here's what goes into a CR Recommended car's Overall Score:

- Road Test Results: CR purchases every test vehicle anonymously (just like you would), ensuring no special treatment from manufacturers. They then put it through 50+ tests at their 327-acre facility. This includes objective measurements of acceleration, braking performance, emergency handling, and real-world fuel economy. They assess how it actually feels to drive.

- Predicted Reliability: This is where owner data is paramount. CR surveys hundreds of thousands of its members about their experiences with their vehicles, analyzing 20 key trouble areas across various model years. This collective wisdom offers a powerful predictive indicator of how reliable a specific model is likely to be.

- Owner Satisfaction: Another crucial metric derived from member surveys. This asks a simple but powerful question: "Would you repurchase this same car if you had to do it all over again?" High owner satisfaction signals that the car delivers on its promises and meets long-term expectations.

- Safety: CR's safety assessment combines dynamic test results (how well a car brakes and handles in emergencies) with independent crash test results from organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA). They also credit the effectiveness of modern safety systems like automatic emergency braking and lane-keeping assist.

When exploring your options, prioritizing models with strong CR scores, especially for reliability and safety, is a smart move. If you're looking for the best family sedans, for instance, checking their rankings is a logical first step.

Beyond CR: Personalizing Your Search

While CR provides excellent objective data, your personal needs are paramount.

- Your Lifestyle: Do you need space for car seats, gear for hobbies, or a vehicle that handles rugged terrain?

- Fuel Economy: How much driving do you do? Hybrid or electric might be worth the premium if you log lots of miles.

- Safety Features: Modern cars offer a suite of advanced driver-assistance systems (ADAS) like blind-spot monitoring, adaptive cruise control, and rear cross-traffic alerts. Decide which are non-negotiable for you.

- Resale Value: Some brands and models hold their value better than others, which impacts your total cost of ownership.

- Insurance Costs: Get quotes for specific models before committing, as premiums can vary widely.

Where to Seal the Deal: Navigating Purchase Channels

Once you know what you want, it's time to figure out where to buy it. Different channels offer different advantages and levels of convenience, and understanding them will help you target the best deal.

Traditional Dealerships (New & Used)

Most car purchases still happen at dealerships. They offer convenience, financing options, and the ability to test drive.

- New Car Dealerships: Offer the latest models, manufacturer warranties, and brand-specific incentives. They also handle all the registration paperwork.

- Used Car Dealerships: Can be independent or part of a new car franchise. They offer a wide variety of makes and models, but quality can vary. Look for reputable dealers with good reviews and transparent pricing.

Tips for Dealerships: - Do your homework: Know the average transaction price for the car you want before you step onto the lot.

- Don't rush: Salespeople want to close quickly. Take your time, ask questions, and don't feel pressured.

- Focus on the "out-the-door" price: This includes all taxes, fees, and the price of the car itself. It's the only number that truly matters.

- Separate negotiations: If you have a trade-in, negotiate its value separately from the price of the new car.

The Rise of Online Retailers

Companies like Carvana, Vroom, and Shift have revolutionized used car buying, offering a fully online experience with home delivery.

- Pros: Convenience (buy from your couch), often fixed, no-haggle pricing, and a wide selection from across the country. They handle paperwork and delivery.

- Cons: You can't test drive before purchase (though most offer a generous return window). You rely heavily on their inspections and descriptions.

- Best For: Buyers comfortable with online transactions, those with specific needs that might not be met locally, or those who dislike the traditional dealership experience.

Private Sales

Buying from an individual offers the greatest potential for savings, as you cut out the dealer's overhead. However, it also comes with the most risk and responsibility.

- Pros: Lower purchase price, more room for negotiation, and you can often get a clearer history directly from the previous owner.

- Cons: No warranty (unless remaining from the manufacturer), you handle all paperwork (title transfer, registration), and a higher risk of hidden problems or misrepresentation. You're responsible for due diligence.

- Essential Steps for Private Sales:

- Verify ownership: Ensure the seller has a clear title.

- Get a vehicle history report: Use services like Carfax or AutoCheck to check for accidents, salvage titles, and service history.

- Pre-purchase inspection (PPI): ALWAYS have an independent mechanic inspect the car before you buy. This is non-negotiable.

- Meet in a safe, public place: If possible, meet at your bank for payment and title exchange.

Mastering the Negotiation: Tips for a Better Deal

Negotiating for a car can be daunting, but with the right approach, you can save hundreds, if not thousands, of dollars. Remember, knowledge is power.

- Research, Research, Research: Walk in knowing the average transaction price for the exact make, model, trim, and year you're looking for. Websites like Kelley Blue Book (KBB), Edmunds, and NADAguides offer excellent pricing data.

- Get Pre-Approved for a Loan: Even if you plan to finance through the dealership, having an external pre-approval (from your bank or credit union) gives you leverage. It sets a ceiling for the interest rate the dealer needs to beat.

- Focus on the "Out-the-Door" Price: This is the total cost including the vehicle price, taxes, registration fees, and any dealer add-ons. Don't let them talk only about monthly payments. A low monthly payment over a longer term can hide a much higher overall cost.

- Keep Your Trade-in Separate (Initially): If you have a trade-in, negotiate the price of the new car first. Once that's settled, then introduce your trade-in. This prevents the dealer from shifting money between the two transactions to make it seem like you're getting a good deal on both. Before heading to the dealer, get an estimate of your current car's value; resources like a guide to selling your old car can help you determine its worth.

- Be Prepared to Walk Away: This is your strongest negotiation tool. If you're not getting the deal you want, or if you feel pressured, simply thank them for their time and leave. Often, this can prompt a better offer.

- Say "No" to Unwanted Add-ons: Dealers often try to sell extended warranties, paint protection, fabric treatments, or nitrogen in tires. Research these thoroughly. While some extended warranties can be valuable, many are overpriced or unnecessary.

- Choose Your Timing: The end of the month or quarter, or specific holidays, can be good times to buy when salespeople are trying to meet quotas. Also, consider buying last year's model when new models are arriving on lots.

Before You Sign: Final Checks & Paperwork

You've researched, negotiated, and found your perfect ride. But don't let excitement cloud your judgment in the final stretch.

- Thorough Test Drive: Even if you've test driven before, do another one, specifically focusing on the actual car you're buying. Check everything: lights, wipers, horn, infotainment, A/C, heating. Listen for any unusual noises.

- Pre-Purchase Inspection (for Used Cars): We can't stress this enough. Pay an independent mechanic to inspect any used car you're seriously considering. They can spot issues that aren't obvious to the untrained eye, saving you from major headaches and expenses down the line.

- Review the Purchase Agreement Line by Line: Don't rush. Ensure every number matches what you agreed to. Look for hidden fees, "market adjustments," or products you didn't request. Verify the APR, total price, and trade-in value.

- Understand Warranties:

- New Cars: Confirm the specifics of the bumper-to-bumper and powertrain warranties.

- CPO Cars: Understand the length and coverage of the extended CPO warranty.

- Used Cars: If buying from a dealer, know if it comes with any warranty (e.g., 30-day, 1,000-mile). If "as-is," understand you have no recourse for future repairs.

- Consider GAP Insurance: As discussed earlier, if you're putting down a small down payment or financing for a long term, GAP insurance can be a worthwhile safeguard against early depreciation. If the dealer's price is too high, you can often find it cheaper through your own insurer.

- Secure Insurance: You cannot legally drive off the lot without proof of insurance. Have your policy activated or ready to go.

Beyond the Purchase: Your First Weeks with a New Car

Congratulations, you're a car owner! But the journey doesn't end when you drive away. A few crucial steps ensure a smooth transition into ownership.

- Registration and Plates: If bought from a dealer, they'll usually handle the initial paperwork. If a private sale, you'll need to visit your local DMV or equivalent agency to transfer the title and register the vehicle.

- Familiarize Yourself: Take time to read your owner's manual. Learn about your car's features, maintenance schedule, and any specific quirks. Modern vehicles are complex, and knowing how to use all the safety and convenience features will enhance your driving experience.

- Schedule First Maintenance: For new cars, follow the manufacturer's recommended schedule. For used cars, consider an early oil change and a general check-up to establish a baseline.

- Enjoy the Ride: Take pride in your informed decision. Whether it's a shiny new model or a reliable pre-owned vehicle, you've navigated a complex process successfully. You're now equipped with the knowledge to make other significant purchases, even something as complex as your guide to iPad Pro (3rd generation).

Your Next Mile: Confident Car Ownership

Buying a car is one of the most significant financial decisions many people make, and it’s often fraught with anxiety. By breaking down the process, understanding the terminology, leveraging expert research, and approaching negotiations with confidence, you transform that anxiety into empowerment.

You now have the tools to evaluate pricing, assess models for reliability and safety, and navigate the various purchase channels, whether new, CPO, or used. Armed with this guide, you’re not just buying a car; you’re investing in your mobility, freedom, and peace of mind. Drive safely, and enjoy the open road ahead.